Why Going Concern Matters: UK Business Valuation

Going concern valuation. Why is business valuation so important? Well, for starters, it's a fundamental aspect that influences a range of critical decisions. If you're an investor, knowing a business's worth helps you decide whether to buy, hold, or sell shares. For business owners, a proper valuation can guide you in setting the right price if you're looking to sell your enterprise. Strategy consultants, like those advising on mergers or acquisitions, rely heavily on accurate valuations to recommend the best course of action for their clients. In the United Kingdom, one of the most popular methods for this purpose is the "Going concern valuation."

What exactly is going concern valuation, and why is it so relevant in the UK? This valuation approach assumes that a business will keep running for the foreseeable future, without any plans for liquidation. It's not just about tallying up assets and liabilities. It's about looking at future cash flows, growth prospects, and overall financial stability. For example, if you're evaluating a tech start-up in London, you'd consider not just its current software and hardware but also its potential for market expansion and revenue generation in the coming years. This method is particularly useful in the UK, where the business environment is both dynamic and subject to various economic uncertainties, such as Brexit or market fluctuations. Therefore, understanding the intricacies and challenges of Going Concern Valuation is crucial for anyone involved in the business decision-making process.

What is Going Concern Valuation?

Going Concern Valuation is a method used to assess the value of a business that is expected to continue operating for at least the next year. Unlike other valuation methods that focus solely on a snapshot of current assets and liabilities, this approach goes a step further. It considers future cash flows, the potential for growth, and the overall financial stability of the business. For example, if you're evaluating a local bakery, you wouldn't just count the ovens and bags of flour. You'd also look at the bakery's customer base, its plans for introducing new types of bread or pastries. You also assess its ability to generate profits in the coming months and years.

This valuation method is particularly useful in dynamic and uncertain economic environments. It allows investors, business owners, and consultants to make more informed decisions. When using Going Concern Valuation, you're not just looking at what the business is worth today. You're trying to gauge what it could be worth in the future. Let's say you're considering investing in a renewable energy project. You'd examine not only the current infrastructure but also the project's potential to scale, government policies that could affect it, and future revenue streams from energy production. By taking a more comprehensive view, Going Concern Valuation offers a more accurate understanding of a business's true value.

Why is it Relevant in the UK?

The UK boasts a vibrant business landscape that includes both well-established enterprises and emerging start-ups. This diversity makes the concept of going concern valuation especially relevant. One key area where this comes into play is in mergers and acquisitions, which are quite common in the UK. When two companies consider merging or when one company thinks about acquiring another, a going concern valuation offers a more complete picture of the target company's value. This is crucial for negotiating fair terms and ensuring that the transaction benefits both parties. For example, if a manufacturing firm is considering acquiring a smaller supplier, a going concern valuation would look beyond just the supplier's current assets. It would also consider future contracts, growth potential, and even the skills of its workforce.

Investors and regulatory bodies in the UK also place a high value on the going concern principle. Investors are increasingly focused on the long-term prospects of a business, not just quick returns. A going concern valuation helps them understand the sustainability and future profitability of a company. It makes it easier to decide whether to invest or not. For instance, an investor looking at a green technology firm would be interested in its long-term plans for innovation and market expansion, not just its current revenue. On the regulatory side, both UK GAAP and IFRS mandate that companies prepare their financial statements based on the going concern assumption, unless there's a good reason to believe the company will cease operations. This ensures a level of transparency and reliability in financial reporting. It makes it easier for all stakeholders to make informed decisions.

The Methodology

The most common methods for going concern valuation include:

Discounted Cash Flow (DCF)

Discounted Cash Flow, commonly known as DCF, is a valuation method that focuses on a business's future earnings. In simple terms, it's about figuring out how much money the business is likely to make in the future and then determining what that money is worth today. For example, if a restaurant is expected to generate a certain amount of revenue over the next five years, those future earnings are calculated and then discounted back to their present value. The discounting process takes into account the time value of money, which is the idea that a pound today is worth more than a pound in the future because of its earning potential.

The DCF method is particularly useful for businesses with predictable cash flows and growth rates. It's a popular choice for valuing a wide range of enterprises, from retail shops to software development firms. However, it's crucial to be cautious with the assumptions made during the estimation process. Factors like growth rates, discount rates, and future market conditions can significantly impact the valuation. For instance, if you're evaluating a gym, you'd need to consider membership renewals, the cost of new equipment, and even local competition. By carefully examining these variables, the DCF method provides a comprehensive and nuanced understanding of a business's true value.

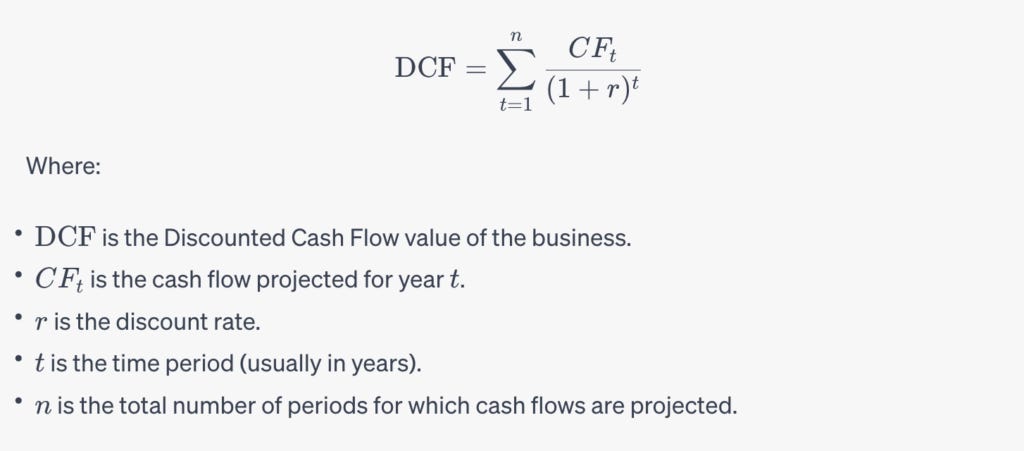

Certainly, the formula for the Discounted Cash Flow (DCF) method can be expressed in a straightforward manner. The DCF valuation is essentially the sum of the present values of future cash flows, discounted back to today's value using a discount rate. The formula can be represented as:

Perpetuity formula

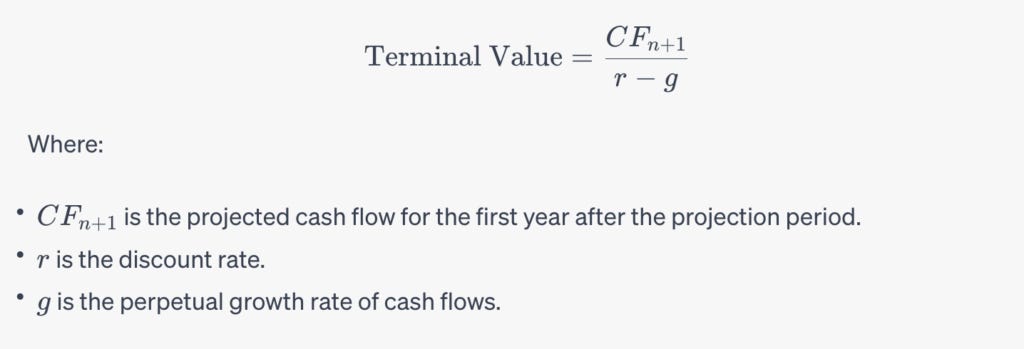

For businesses that are expected to generate cash flows indefinitely, a "perpetuity" formula can be used for the terminal value, which is then discounted back to the present value. The terminal value formula in a DCF model is often calculated using the Gordon Growth Model as follows:

The terminal value is then discounted back to the present value and added to the sum of the discounted projected cash flows to get the total DCF value of the business.

These formulas provide a structured way to evaluate the present value of future cash flows, offering a robust tool for business valuation. However, it's essential to remember that the accuracy of a DCF valuation heavily depends on the quality of your assumptions about future cash flows, the discount rate, and the growth rate.

Comparable Company Analysis (CCA)

Comparable Company Analysis, or CCA, is a valuation method that involves looking at similar businesses in the same industry to gauge the value of the company you're interested in. The idea is straightforward: if you know how much other businesses are worth, you can make a good estimate of how much your target company should be worth. For example, if you're evaluating a restaurant, you might look at other restaurants in the same city with a similar customer base, menu, and size. By comparing metrics like revenue, profit margins, and growth rates, you can get a better sense of what the restaurant's value should be.

One of the key steps in CCA is selecting the right set of comparable companies. It's crucial to choose businesses that are truly similar in terms of size, growth prospects, and market niche. Once you've identified these companies, you'll need to gather financial data like earnings before interest and taxes (EBIT), price-to-earnings (P/E) ratios, and other relevant metrics. These numbers are often publicly available for listed companies, making it easier to perform the analysis. For instance, if you're looking at a software development firm, you'd want to compare it to other firms that focus on the same type of software, rather than those that are in a completely different sub-sector like gaming.

While CCA is a valuable tool, it does have its limitations. One of the main challenges is that no two companies are exactly alike, which can make direct comparisons difficult. Additionally, the method relies heavily on the availability and quality of financial data. If you're looking at private companies or start-ups, this information might not be readily available. Despite these challenges, CCA remains a widely used and effective method for business valuation, offering a real-world context that other methods might lack.

Market Capitalisation

Market capitalisation, commonly known as market cap, is a straightforward way to determine the value of a publicly traded company. It's calculated by multiplying the company's share price by the total number of its outstanding shares. For example, a tech company has one million shares outstanding and each share is priced at £50. The market cap would be £50 million in this case. This method is often used because it's quick and easy. You can usually find these numbers readily available on financial news websites or stock market apps.

However, it's important to note that market cap has its limitations and can sometimes be misleading. The stock market is influenced by a variety of factors, including investor sentiment, news, and economic conditions, which can cause share prices to fluctuate. These fluctuations can make the market cap a less reliable indicator of a company's true value. For instance, during a market bubble, share prices might soar, inflating the market cap and making the company appear more valuable than it actually is. Conversely, during a market downturn, the market cap may plummet, suggesting that the company is less valuable, even if its fundamentals remain strong.

Despite these limitations, market cap remains a popular valuation metric, especially for quick comparisons or initial assessments. It's often used in conjunction with other valuation methods like Discounted Cash Flow (DCF) or Comparable Company Analysis (CCA) to provide a more comprehensive view of a company's worth. For example, analysts might look at the market cap of Apple Inc. . Thus, they get a quick sense of its size and then delve deeper into its financials using DCF or CCA for a more nuanced understanding. This multi-method approach helps to offset the limitations of relying solely on market cap for valuation.

Challenges and Pitfalls

Economic Uncertainty

Economic uncertainty is a significant challenge when it comes to business valuation. Particularly, in the UK, factors like Brexit and the COVID-19 pandemic have had a considerable impact. These events can disrupt supply chains, alter consumer behaviour, and lead to regulatory changes. All of these can affect a company's long-term prospects. For example, a UK-based exporter might see its valuation fluctuate due to trade agreement changes post-Brexit. Similarly, a hospitality business could face valuation challenges due to the unpredictable nature of pandemic-related restrictions.

Overemphasis on Financials

Another pitfall in business valuation is the overemphasis on financial metrics. While numbers like revenue and profit margins are important, they don't tell the whole story. Intangible assets like brand value, customer loyalty, and intellectual property also contribute to a company's worth. However, they are often harder to quantify. For instance, a fashion retailer might have a strong brand that commands customer loyalty. This makes it more valuable than what the balance sheet alone would suggest. In such cases, overlooking these intangibles can lead to an undervaluation of the business.

Data availability

Data availability is a third challenge, particularly for private companies and start-ups. Publicly traded companies are required to disclose financial information. However, private entities often have limited data available for public scrutiny. This makes it difficult to perform a comprehensive valuation using traditional methods. For example, if you're looking to invest in a start-up, you might find that it has not yet generated enough financial history to conduct a thorough analysis. In such cases, alternative valuation methods that rely on market potential or technological innovation may be more appropriate.

Going concern valuation

Going concern valuation is an indispensable tool in the UK's complex business landscape. However, it's not without its challenges. A multi-faceted approach that combines financial metrics with qualitative factors can offer a more holistic view of a company's value. As the business environment continues to evolve, so too will the methodologies and best practices for going concern valuation. Therefore, staying updated and adaptable is key for anyone involved in the valuation process.

The importance of going concern valuation cannot be overstated, especially in a market as dynamic as the UK. It serves as a robust framework for understanding the intrinsic value of a business, thereby aiding in more strategic decision-making. However, it's crucial to approach this with a balanced perspective. Take into account both the quantitative and qualitative aspects of a business.

Whether you're a business strategy consultant or an investor, mastering the art of going concern valuation is not just an option; it's a necessity.